Today, I want to introduce you to a competitor that you may not have even known existed. The Real Estate Investor (aka the flipper, the wholesaler, we buy ugly houses). By the end of this article, you will know exactly how to handle these phone calls and use them to your advantage.

While there are a few differences in these folks, the premise is basically the same – buy cheap. But you can take advantage of them!

What is a Real Estate Investor?

A Real Estate Investor is someone who buys houses and sells them to other investors. They go about this in two different ways.

First, a Real Estate Investor may buy a home from someone for a lower amount and then resell it to another investor or end buyer for a higher amount. This is pretty common. In this case, the investor has his money on the line so he relies on his MAO or Maximum Allowable Offer formula. For one wholesaler I spoke with during a seller interview, his magic number was 70%. He is willing to pay 70% of the retail value minus the repairs.

A Real Estate Investor will also go to someone, offer to sell their house at a certain price and then keep the spread (the difference between what they owe the seller and what the buyer pays). In this case, the return can be less than 30% because the seller has not laid out any money. The catch for the Real Estate Investor is that there is (typically) a very short time where he must sell the home – typically 30-45 calendar days or the deal goes south.

Why do I care about this?

There are two reasons that you should care about what a Real Estate Investor does.

First, he is your competition. In many cases, you are not targeting the same buyers. He is trying to find houses that would appeal to investors (usually to rent). You are trying to find a buyer who will live in your home after you sell it. However, there may be some overlap depending on your home. If you are selling a home above $300,000 there is likely not much overlap. But if your home is under $300,000 there is the potential that your house may appeal to both an end buyer and an investor.

You need to know that houses sold by Real Estate Investors may not pop up on traditional sites or in the MLS System.

I recently spoke with Ryan during one of my seller interviews and he was a Real Estate Investor. Ryan uses free tools to list his house. These include sites like Craigslist, Zillow, and Trulia. He also hustles. He has a lot of contacts and hits the phones once he has a house to sell.

When Ryan sells a home, you may not have even known that it was for sale.

Why? He does not rely on walk in traffic. He relies on buyers using the internet and his phone contacts.

Worse yet, if he buys the home and then resells it – there are two sales on the market that affect what houses are going for in your neighborhood.

Let’s imagine there is a 3 bedroom, 2 bathroom, 1,600 square foot house for sale. Ryan is able to get it for $130,000 or $81.25 per square foot. He turns around and sales it for a profit. Remember, he is looking to get the house at 30% off. Now, you have a second sale on record for $180,000 or $113 per square foot.

Ryan’s goal is to get this house under market value and sell it for as close to market value as possible. Let’s say the market value was $185,000. If a private buyer would have paid market value, the average price per square foot would have been $115. Instead, with the two sales combined, the average price per square foot is $97. That is a $16 a square foot difference.

Is Ryan a bad guy? Not at all. He is filling a need in the marketplace. If he was not filling a need he would be out of business.

How can I take advantage of this situation for my own benefit?

Glad you asked. There are two ways that you could take advantage of this situation.

When I spoke with Ryan, he mentioned he needed more buyers. He can easily find houses to buy, but he has a hard time finding buyers. At the end of the call, he told me that he was willing to pay me for any referrals I sent his way. Cha-Ching!

So, here is what you can do…

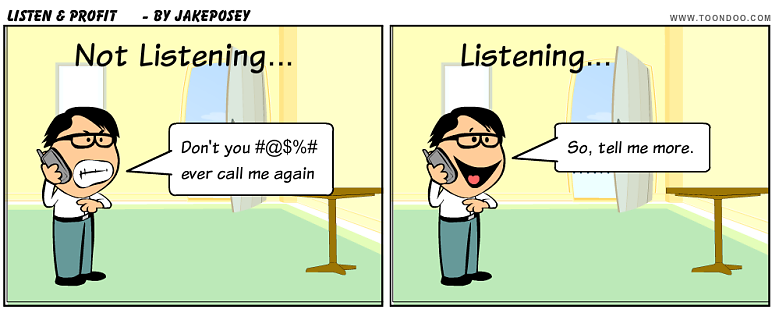

If you have a Real Estate Investor calling you, and you will after you list your home for sale by owner, listen to what he has to say. Once you tell him no, ask if he has listings similar to your current home. If he does, ask him how much he would give you if you were able to send a buyer his way who bought a house.

Your Uninterested Buyer = Investor's Buyer

When, you find a buyer who is not interested in your home, ask the buyer if he wants you to pass his name along to a friend who has some houses for sale that are not listed yet. Give the name and phone number to the Real Estate Investor and give the Real Estate Investor's information to the buyer. You could make a few hundred dollars and make two people really happy. Win – Win – Win

But wait, there is more!

When you sell your home, you are going to need to move somewhere, right? Tell the Real Estate Investor what kind of home you are looking for and see if he has any inventory that appeals to you. You could save a lot of money without a real estate agent and find a great new home.

What if I like what the investor has to say?

In your initial conversation with the Real Estate Investor, you may like what he has to say. Invite him to come over and look at your house. This will likely be your first showing, so make sure he sends you proof that he has the money in the bank for at least 70% of your asking price.

Listen carefully, but take it with a grain of salt.

When he comes to your house, he is going to give it a good inspection and tell you what he thinks is wrong with the house. Listen carefully but take it with a grain of salt. I say to listen carefully because he will point out things that he does not like or something that needs fixed that you may not have noticed. It is always good to another’s perspective so you can be ready when the right buyer comes along.

Next, he is going to make you an offer. He may make you an offer right there or he may need to go run some numbers. Listen to his offer. It is going to be lower than your listing price – likely much lower.

You may find that he is making an attractive offer. (I doubt it, but I felt it needed to be said.)

It is always good to another’s perspective so you can be ready when the right buyer comes along.

Regardless if you find the offer appealing or not, you now know what someone else thinks they can sell your home for. This can validate your listing price (and who does not like a little validation).

Remember from the MAO above, the offer is likely going to come in at 70% of the retail price minus any repairs. To get the retail price, take his offer, divide it by 7 and then multiple it by 10. If you have any major repairs, add those in to the price after you multiply.

But how did he get the retail price?

Many individuals who do this professionally will have access to the same MLS system that real estate agents use to get their comps (comparable houses). He will find comps and use that on which to base his offer. You can ask him what comps he used to arrive at that offer. He probably won’t share it with you, but the worse that can happen is he says no – so ask anyway.

Will his price be accurate?

If he is an experienced Real Estate Investor, he will be pretty accurate because he is still in business. You can find out if he is experienced by asking two questions. How long have you been doing this and how many homes have you sold.

Someone experienced will have been in business for more than 5 years and sold at least 20 houses. Or he will have sold at least 50 houses in less than 5 years. Make sure you ask before inviting him to come see the house. Don't waste your time on inexperienced investors.

Executive Summary

Real Estate Investors are individuals who buy homes and sell them to other investors or who tells you he will sell your home for a certain price and goes to find a buyer. These individuals want to buy your home at 70% of the retail value. Be bold. Ask the investor if he has homes like yours and see if he will pay you to refer buyers to him. Refer buyers who look at your home but are not interested. Ask him if he has homes that match your needs for your next home. You may find your dream home. You can also invite the Real Estate Investor to look at your home and make an offer. This will allow you to get feedback on what is right and wrong with your home. Use his offer to validate your listing price. Just make sure that he is experienced before inviting him.

Your turn

We try hard to answer all of your questions when we are interviewing sellers and writing – but we can miss a few. Did you have a question we did not answer? Ask it in the comments below and we will answer it within 48 hours.

You can also share the love. If you like what you read, you can click the facebook like over to the side and this will help others like you find this article.

Download the full case study here showing you how to sell your home on your own.